HOME LOANS - CRYPTOCURRENCY BACKED BY REAL ESTATE

HOME LOANS is a platform for investment in real estate secured loans around the world, built on the basis of the Ethereal platform. The HlCoin Token platform will be equipped with real estate objects and will be traded on crypto exchanges. HOUSEHOLD platforms use complex algorithms to predict the creditworthiness of all customers and in just 20 minutes borrowers can get their first loan to buy real estate in their life only from their smartphones. All customers have the ability to pay less interest and have a higher credit rating, if they use our platform more often. All Big Data and Aggregate Credits are stored in Blockchain. Thousands of investors have access to the millions of new customers we bring into the world economy and millions of people will have the opportunity to purchase property anywhere in the world.

Our product.

International loan platform for real estate HOME LOANS provides loan types such as:

- Loans for housing under construction.

- Loans for secondary housing.

- Loans for commercial real estate.

- Loans for the purchase of land

- Loans for own property.

Proposed benefits.

HOME PAGE for the crypto community: Creation of crypto ecosystems.

Our goal is to help private investors and businesses working on blockchain technology to expand their client base significantly by accessing real estate lending and mobile marketing platforms for businesses. According to our long-term strategy, HOME LOANS should be part of the cryptosystem. Going forward, we are considering integration with the following hightech products:

Everex - Cross border payment system. Provision of crypto funds for borrowers.

Civic - Improved procedures for the identification and verification of the borrower.

COSMОS - Network and infrastructure for interaction between blockers.

HOUSEHOLD PAYMENTS for business: attract new and returning old customers.

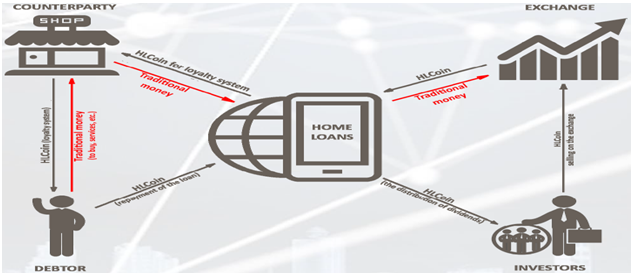

The business model is very simple. The service (mobile application HOME LOANS) directs the client to the partner (counterparty). If the client makes a purchase or use of the service, the seller returns a portion of the amount in HLCoin (provided free of charge to the platform) to the customer (the borrower) as a cashback, and with traditional money to the DAILY HOME account. It motivates the borrower to come to our partners and make a purchase - a moving cap generator. Now businesses do not have to spend a lot of money on advertising to attract customers - they'll come alone.

LEGAL HOME for people.

This gives people the opportunity to purchase property without using traditional methods such as banks. The platform has a separate assessment system that analyzes the borrower's credit history and analyzes the production of HLCoin in mobile HOME LOANS applications. This provides a better opportunity for borrowers whose credit history is damaged due to circumstances beyond its control.

HOUSEHOLD LOANS for local partners: global business scaling.

We develop business development algorithms in new countries based on extensive work experience and market studies and legal segments. We will launch an international franchise after launching the platform. We will share with our franchise all necessary market research, knowledge of risk management, knowledge in the field of loan appraisal.

Our Goal

Creation of an international platform for Peer-to-peer lending on Ethereum Blockchain, using our own HLCoin's cryptocurrency to lend people to buy real estate around the world at a minimum interest rate from private investors without resorting to intermediaries in the sale and purchase of peer -to-peer P2P (peer-topeer) transactions. Everyone who owns HLCoin is an investor.

Peer-to-peer lending (peer-to-peer lending, social lending, P2P lending) is the lending to individuals by the involvement of traditional financial players such as banks.

Such lending will occur via the HOME LOANS online-platform using various credit and financial verification tools, as well as its own scoring system. This platform will not depend on the economic factors of the state.

borrower are located in different states.

The world market of p2p-lending which is linked with the revolution in finance is going to triple by 2020 and reach $ 286 billion.

- Create an international platform for peer-to-peer loans on Ethereum Block Chain by utilizing HLCoin's cryptic infringement, create private platforms for peer-to-peer loans on Ethereum Block Chain and make private investors with minimum interest rates Purchase of peer-peer P2P (peer-to-peer) transaction purchasing real estate. Everyone who owns HLCoin is an investor.

- Peer-to-peer loans (peer-to-peer investments, social lending, P2P loans) are individual loans to individuals without the involvement of traditional financial players such as banks.

- HOME LOANS is an easily accessible financial platform that helps people around the world convert their savings into HCoins currency and gain real yields from real estate financing, real estate purchases, and inflation revenue to support real estate.

- HLCoin reduces the cost of real estate Collateral lending, improves the speed of traditional business, and participates in third place due to the innovative financing platform opportunity for smart contracts and real estate loans It makes unnecessary.

HOME-LOANS SOLUTION PARADIGM

The home loan paradigm is a cryptocurricular approach to solving the housing challenge, as it affects the 1.6 billion people on earth. The question is, what is the home loan approach? .it is easy. First, it will trade residential properties or tokens as exchanges on the Cryptoblockchain platform, which are traded as exchanges on the Blockchain. Second, the Home Loans platform uses an algorithmic system that verifies and validates the borrower to access a home loan from their smartphone device from anywhere in the world. This creates space for functional mobility and ease of transactions in terms of user access to loans for home loans. Third, home loans have an insurance paradigm with low interest rates for every transaction and customers on the platform can pay with ease and easily. This also opens them up to investors who invest and allow more clients to obtain loans for real estate around the world.

HOME-LOANS TOKEN OWNER WINS

The owners of the home loan canken to use tokens for many purposes on the platform. Therefore, tokens secured for real estate is not susceptible to volatility of any kind. That means they are scalable and reliable. Owned token gives the user the opportunity to invest in loans and loans for real estate. Tokens also gives the user the ability to do a quick transaction in a cheap way than the marginal market price cost. A token also has the ability to buy and use the asset fund on the platform. In addition, possessing token users gives the willpower to enjoy collective lending for a large amount of real estate. Token ownership thus guarantees the place of investment growth, and tokens can support the disbursement of loans over time for real estate assets. In addition, tokens can be used to replace properties in real time.

HOME-LOANS FEATURES

The home loans are a platform built on the blockchain, with the ability for users to enjoy credit, real estate and ownership of token-disassembled real estate objects. In addition, the home loan platform for cross-border transactions is simple and easy, flexible, fast and reliable for users. Therefore, transparency stats are the ultimate virtue and profit of 1.6 billion people already on Earth. Therefore, the platform also allows the creation of a virtual identity that evolves as the token grows. In addition, through the legal structure, investors generally enjoy more legal services and registers on the blockchain. The utility and implementation of Etheruem's Smart Contracts thus provides a useful and optimized balance for the user on the blockchain, which is also scalable and manageable. The truth is that people are always in need of houses and all kinds of real estate, while investors in real estate are coveting the portfolio of more clients looking to invest in real estate. This is the ownership and big-data variance that home loans offer to everyone involved. which is also scalable and manageable. The truth is that people are always in need of houses and all kinds of real estate, while investors in real estate are coveting the portfolio of more clients looking to invest in real estate. This is the ownership and big-data variance that home loans offer to everyone involved. which is also scalable and manageable. The truth is that people are always in need of houses and all kinds of real estate, while investors in real estate are coveting the portfolio of more clients looking to invest in real estate. This is the ownership and big-data variance that home loans offer to everyone involved.

ROADMAP

HOME LOANS TOKEN DETAILS

The HLCoin is represented as HLC on the Exchange Blockchain platform. It has a total token offering of 150,000,000 tokens with a distribution of 120,000,000 reach and an accelerated plan to increase its value to $ 800,000 for users. The hardcap is estimated at $ 50 million. Therefore, all settable tokens are burned. The home loan uses the ECR20 coinage and the starting price of 1 HLC = $ 1 dollars. The ICO for housing loans ends in the last week of February 2018, the ICO is just opened. The pre-ICO soft cap is $ 200,000 with HLCoin = $ 1 plus a 50% bonus for all users who invest.

TEAM

For more information, please visit the following link:

Website: http://home-loans.io/

White Paper: http://home-loans.io/White_Paper_ENG.pdf

Facebook: https://www.facebook.com/HLCoin/

Twitter: https://twitter.com/HomeLoansCoin/

Telegram: https://t.me/HomeLoanseng

Bitcointalk (doblok) : https://bitcointalk.org/index.php?action=profile;u=1035549

ETH : 0x45CC001673969f7a5e77ab858BaD85d650427227

Tidak ada komentar: