Debitum Network is a Distributed Ecosystem

What is Debitum?

Debitum Network is a distributed ecosystem consisting of various partners involved in the financing process of small and medium enterprises (SMEs), risk assessors, insurance companies, investors, debt collectors and other opponents who all use Debitum tokens as the only means of payment possible . among themselves while transacting within the Debitum Network. The Debitum token utility will be multifold. We have analyzed possible token models, apply these findings to the use of the Debit Network and Debitum's desire to perform two key roles in the ecosystem.

The role of value exchange to build and maintain the economy Debitum Network - The Debit Token will be used by borrowers and investors to purchase services on ecosystems with the ability to set the price of services obtained in accordance .The toll role forces the counterparty to have skin in the game - the Debitum Token will be used as collateral to guarantee delivery of counterparties services. Token will also be used to run a Trust Arbitrage intelligent contract that will show the level of trust of each network partner within the ecosystem. In this way the token will ensure and guarantee the credibility of the Network Debitum.

Credit World

In accordance with the World Bank's review, about 70% of all micro, small

and medium-sized companies in emerging markets have no access to credit. Strata of small and medium enterprises at most.

1.Decentralized Blockchain

The blockchain design allows to ensure the highest transparency and trust, which allows automated processes using smart contracts and their decentralized properties allow exponential growth of the number of members in solution-based blocking.

The three main pillars of the Debitum Network ecosystem

Debitum Netwrok is based on three important pillars that ensure uniqueness, disruption and will ensure positive results on small credit slots.

- Real Decentralization

- HYBRID connects crypto and fiat

- Trust base

- True decentralization

There are 154 countries represented by the World Bank where the experience of SMEs has a credit slit and where solutions such as the Network Debitum can help close the gap by providing partner ecosystems and linking them with global investors. However, saying that the new Debitum Network team will be established in 154 countries and bringing ecosystems into their own markets will be a mistake.

2. HYBRID connects crypto and fiat

The ecosystem has a designated facilitator to take care of all fiat transactions, should be noted on the block using smart contracts and ensure that the ecosystem can be used from day one.

The hybrid approach allows us to combine the current state of business practice with the operatonal ecosystem infrastructure blockade from day one. The Debitum Network will be able to develop and transfer capital related to the loan on the blockchain. Meanwhile, Debitum will work hard to promote blockchain solutions to SMEs worldwide.

3. Base of Trust

By combining reliable and efficient fiat operations, Debitum Network's blockchain-based financing process will ensure high interest from SMEs and investors. Because borrowing is primarily driven by trust in the borrower, the Debitum Network will ensure that all transactions will be related to the trust of smart contract arbitration that will give trust to each of the single partners as well as partner partners.

To ensure market confidence Debitum arbitration with smart contracts will be a blockchain-based fact such as smart service contracts involved. Any positive experience (such as a successful Smart Implementer service contract) will add some trust rating value.

Token Distribution

Price:

The price of Debitum will increase by two stages during which Crowdsale offers an opportunity to reward the first supporters.

Step 1

3 750 DEB for 1 ETH reach 4000 ETH

2nd step

3,300 DEB for 1 ETH up to 25,000 ETH

Step 3

2,888 DEB for 1 ETH up to 50,000 ETH

- Minimum recommended donation: 0.1 ETH

- All undistributed chips will be blocked and frozen.

Learn more about what we have achieved so far

2015 - Q2 2017

Start of the company

2015: Incorporated DEBIFO - finance companies alternative

2016.01: Join the financial platform Mintos p2p

2016.10: Achieving a financing agreement with a private debt fund MUNDUS

2017.02: Debitum Ecosystem envisioned

2017.06: Achieving 3M EUR portfolio, nearly 20M asset turnover EUR

Q3 2017

Creating Proof of Concept

2017.07: Extending core teams with business and technology

advisers 2017.08: Establishing global business development teams

2017.09: Build and deploy the MVP version on the Etereum Ropsten block 2017.09

: Align with the first counterparty of the

Q4

2017.09 ecosystem Increase funds through Crowdsale

2017.10: Launch marketing campaign

2017.10: Expand the Debitum Network community

2017.10: Combine Debitum Network

2017.12: Chapter Crowdsale A - Raised 1.2 M USD

Q1-Q3 2018

Building Debitum Network 1.0

2018.02: Crowdsale Round B

Product development begun

2018.03: Expanding the Debitum Network team to prepare for global expansion

2018.06: Establishing a Debitum Network in the first target country

2018.09: Testing and auditing Debitum Network 1.0 before public launch

Q4 2018

Debitum 1.0

Network Develops has 1.0 version Debitum Network ecosystem with manual on-boarding generators, additional investors and service providers

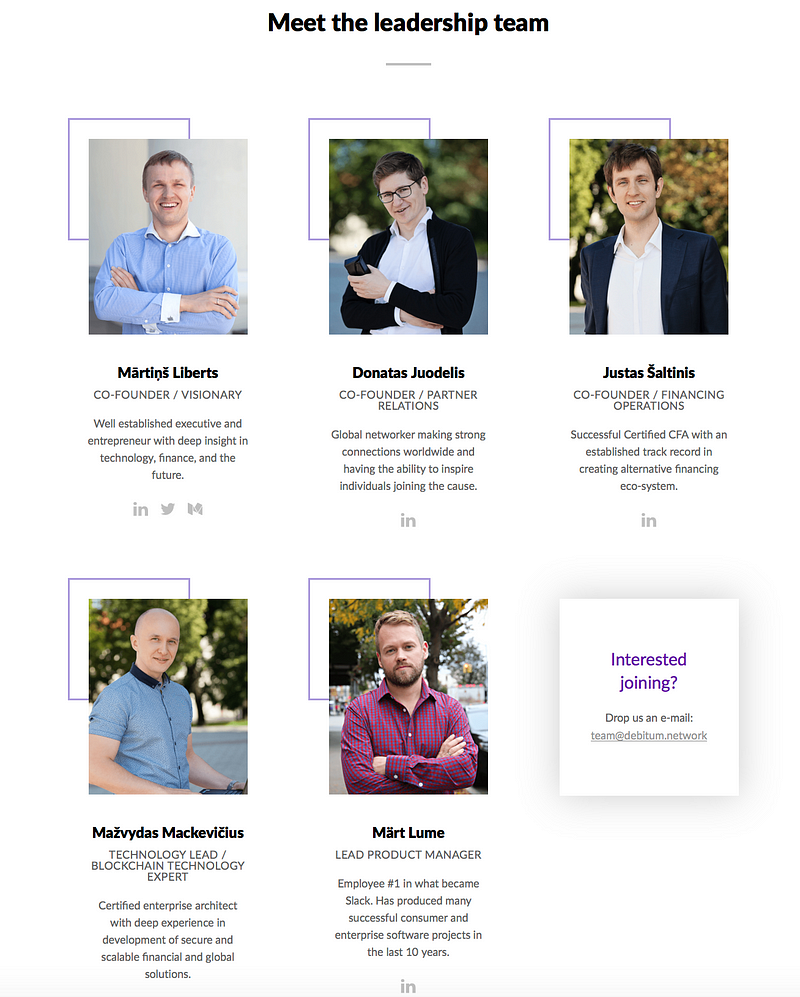

Team

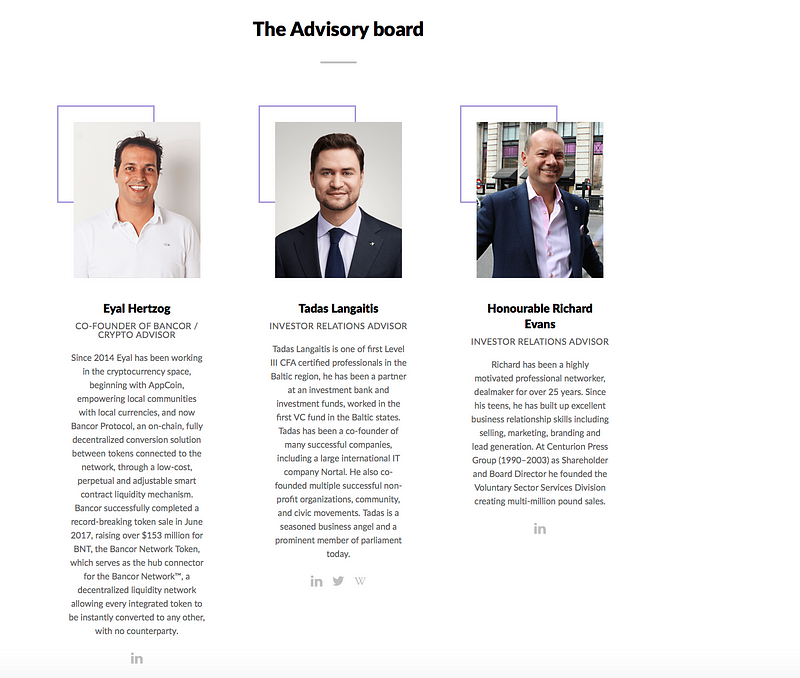

Advisors

FOR MORE INFORMATION PLEASE VISIT THIS LINK BELOW:

WEBSITE: https://debitum.network/

BitcoinTalk: https://bitcointalk.org/index.php?topic=2321064.0

TWITTER: https://twitter.com/DebitumNetwork

WhitePaper: https://debitum.network/whitepaper

My Bitcointalk (doblok) : https://bitcointalk.org/index.php?action=profile;u=1035549

My ETH Address : 0x45CC001673969f7a5e77ab858BaD85d650427227

Tidak ada komentar: