SureRemit - Ecosystem for Global Non-Cash Transfer

Working out of town will be very difficult because it has to go with family. Especially if you have to work overseas. However, not a few people are desperate to try their fate abroad to realize their dreams and a more promising future. Setting feet on strange ground is very difficult, but you can improve the family economy if you want to work hard.

The problem of working in a country is very difficult. Starting to adapt to different weather with their own homes, trying to blend in with local people, having to work in environments and cultures that are equally foreign. But it's not just the problems facing immigrants, the issue of remittances to the family, from the results of the work.

Immigrants face two significant challenges while executing cross-border and local money transfers:

Firstly, the remittance fee is very high. Transferring money through banks and traditional international money transfers can be charged from 7-1 2% of the transferred value. Over the past decade, new digital remittance companies have managed to reduce these costs, but the cheapest service can cost up to 4%. Access points or their withdrawals are also difficult to interact with, especially by populations that are not populated.

Secondly, more than 40% of remittances are intended for special use such as food, clothing, medicine, tuition or utility bill payment. The sender wants to make sure that their money is being used for a predetermined purpose, but it is not possible to be controlled or monitored by cash transfers, as cash creates opportunities for waste and diversion. SureRemit removes the cash layer by eliminating cash agents that utilize cryptocurrency.

The platform connects the sender directly to the merchant that serves the basic needs of their beneficiaries at home. The new Token, Remit, will allow the sender to purchase digital vouchers (SureGifts) that can be sent to billions of their recipients worldwide via SMS or e-mail. These vouchers can be spent directly on goods and services from the SureRemit ecosystem from the partner merchants within their community. This service will significantly reduce transfer costs, while ensuring that the recipient receives the appropriate value as desired by the sender.

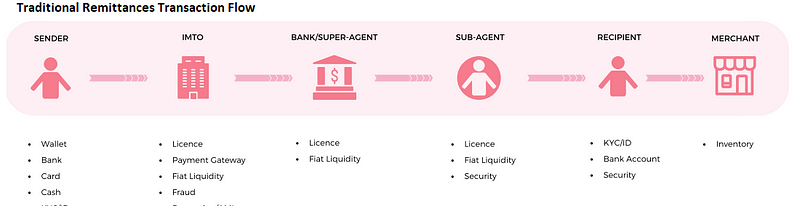

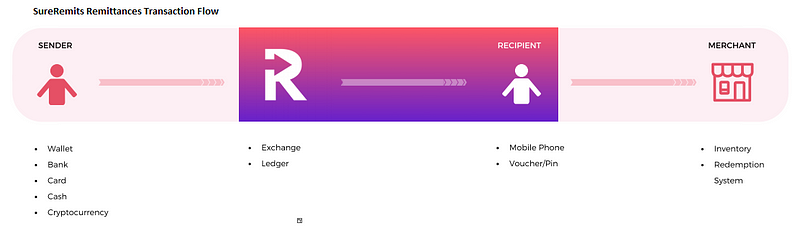

Differences Between Traditional Remittance Transactions with SureRemit Remittance Transactions

Sender; The sender holds cash, debit / credit cards, bank accounts and mobile money purses. They require all of these and meet the detailed KYC requirements of banks and international money transfer operators to meet the terms of the money transfer rules. KYC requirements may also vary depending on the location of the sender.

International Money Transfer Operators (IMTO); IMTO facilitates the transfer of funds from one location to another. Licensed by regulators and working with banks, payment gateways and fraud detection services, they receive cash and transfer the equivalent value to the bank / super agent at the receiving location. IMTO follows the anti money laundering, deception and foreign exchange guidelines.

Bank / Super-agent; The Bank provides liquidity to the local currency at the receiving location. The banks are licensed by local regulatory authorities to facilitate the receipt and conversion of foreign currency into local currency. The Bank acts as its own agent, or works with sub-agents to distribute cash to the recipient. Recipients with bank accounts can also be paid directly to their account.

Sub-Agent; Sub-agents are a key point of interaction for recipients who want to leave. Sub-agents finance the local currency buoy used to complete the recipient. Sub-agents are usually licensed by regulators as "bureau-de-change", and they have little or no control over rates / rates and transaction speed.

Receiver; Retrieval receivers may receive cash into their bank account or mobile wallet, or they can visit the agent's location to receive cash. The recipient presents the details of the verification to confirm the details of the sender and receiver. Typically, government issued IDs are required to access cash, and cash security is the responsibility of the recipient upon receipt

Trader; Merchants accept cash as payments for goods and services.

Sender; Shippers holding cash, debit / credit cards, bank accounts, mobile money purses. They just need to get Remote cryptocurrency and use it to buy vouchers with attributes like merchants and assigned values. Describing KYC requirements is not required to purchase closed digital shopping vouchers.

Cryptocurrency; The Remit coin is the currency used to purchase digital shopping vouchers. Currencies can be purchased with fiat or with other cryptocurrencies.

Receiver; Recipients receive digital shopping vouchers on their phones via e-mail or SMS. This voucher is accepted by the merchant on the SureGifts network as payment for goods and services.

Trader; Merchants can receive these digital vouchers through a simple redemption system. Ecommerce merchants can apply SureGifts or API plugins to accept on their websites. Physical merchants can use the SureGifts redeem application to verify and redeem digital vouchers. More sophisticated traders can integrate SureGifts into their sales systems, and most unsophisticated merchants can redeem vouchers via USSD. Merchants settled directly to bank account or mobile wallet to get redeemed value. With all integrated systems, the sender can monitor and receive redemption confirmations at the merchant's location.

SureRemit Token

SureRemit Token (RMT) is a utility token built on Stellar Network, designed for use by immigrants and customers on the SureRemit platform. Following this standard, the SureRemit token is easily transferable between users and can be supported by wallets and stocks that have supported Stellar lumens.

In the SureRemit ecosystem, the Remittance token (RMT) will be used internally to access vouchers and pay bills for targeted remittances. Immigrants and customers in general will be able to select the countries they want to send value, find the right merchants in a category and make an order voucher to be sent to the recipient via SMS or Email, and pay in the RMT token. Once the order is received, the token will be frozen until the voucher is sent from the SureRemit system. When that happens, the token is transferred to SureRemit. Going forward, we hope to enable direct acceptance of RMT tokens by ecosystem partners, which in turn can be converted to Fiat, this will allow token transfers to occur directly to merchant balances.

Token Sales Requirements

This token sales event allows participants to contribute SureRemit and receive RMT tokens. The RMT token will be requested to take advantage of SureRemit. The RMT token is not a representation of the company's equity.

Key date

Pre-sale begins: December 8, 2017

Pre-sale expired: 5 January 2018

The sales crowd begins: January 10, 2018

Crowd's sale expires: February 10, 2018

Total Token Supply: One Billion RMT Token

One $ RMT = $ 0.02

Accepted: XLM, ETH, BTC, LTC

For more information:

Website: https://token.sureremit.co/

Twitter : https://twitter.com/SureRemit

Telegram: https://t.me/sureremit

Facebook: https://www.facebook.com/sureremit

Medium: https://medium.com/sureremit

My Bitcointalk (doblok) : https://bitcointalk.org/index.php?action=profile;u=1035549

My ETH Address : 0x45CC001673969f7a5e77ab858BaD85d650427227

Tidak ada komentar: