Credito is Building a Credit Intelligence Network

About CREDITO

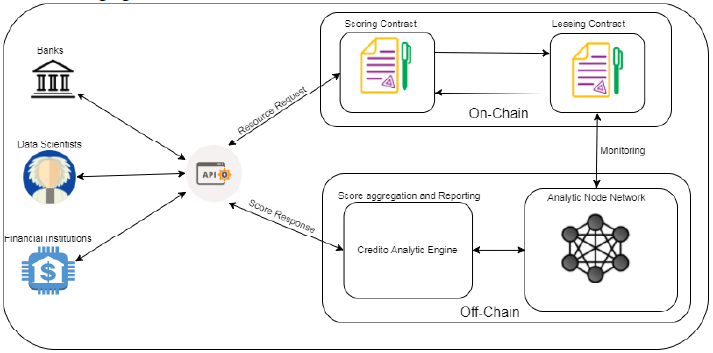

Credito is a decentralized credit analysis network that provides credit scores, transaction costs and credit markets that are supported by Ethereal, Intellectual and IPFS contracts, increasing transparency and reliability.

The introduction of credit markets is decentralized and provides links between lenders and borrowers living around the world. This eliminates physical constraints and reduces traditional loan and administration costs. Visit https://credito.io/

CREDITO TOKEN CreDApp consults with CreditO

At the time, the mandate was given to maintain the Creator risk profile and offer a better interest rate for the network. If the creator wants to quickly fulfill the loan application, he can place an order with the previously reduced interest rate.

Token network credit

Credits include the token ERC20, which serves as the currency, management mechanism, and rewards system with Credito. Credito will be able to set prices and receive payments for its services in the form of loans - the use of markers. All Credito participants must pay royalties on the use of the loan, which will be burned if they can increase the remaining credit demand , The total amount of loans burned on each transaction is directly proportional to the decrease in supply.

It also depends on the exchange rate set by the network, which monitors inventory, market conditions and exchange rates at each specific time of payment. The costs for borrowers and lenders vary depending on the transaction level, we estimate the value at 0.5%. All three parties can integrate the Credito Analytic Engine or from outside

Credito Credit Network for Banking create credit risks by identifying fraudulent transactions in the future so that the industry can make the right decision. Although financial institutions are widely known as one of the most regulated sectors, but the institution remains the target of scammers. The consequences of the fraud are not significant, which led to financial disaster for the bank and the client. Although financial institutions are actively involved in reducing fraud and fraud costs, but they still have no real global intelligence of all known frauds and compromises.

According to the Nilson Report in 2016, the loss of credit card fraud amounted to 2,015-21800000000 dollars. The US, which is 162% more than 2010 figure, which amounts to up to 8 billion US dollars. USA. Losses for 2016 are estimated at over $ 24 billion, and the loss is estimated to reach $ 31 billion in 2020.

The number of transactions with credit and debit cards in 2015 was $ 31 trillion. While the total value of credit card transactions grew nearly 7 percent a year, credit card fraud grew by more than 16 percent a year.

These losses occur throughout the system, including point of sale, ATMs and online transactions. While EMV chip technology has reduced the frequency of fraud in the store, it does not help in online scams.

Monopoly

Global credit intelligence is under the control of several credit bureaus, and it is often claimed that their scoring models are outdated, flawed and not portable as they are specific to a country or region. "More than one in five consumers have a 'potentially significant error' in their credit history making them riskier than they are, and consumers are turning to one of the top three credit bureaus for information on the problem eight million times a year."

Safety

The recent Equifax hack revealed 140 million personalities and personal information to hackers and was labeled as the worst security hole in US history.

By 2016, there are more than 15 million victims of identity theft or fraud, while the total is stolen $ 16 billion.

Central information

Data is collected by a central credit bureau. It is a common misconception that this agency automatically exchanges information, which is not true. These entities are separate companies offering similar services for a fee.

Since credit scores are non-transferable, low-risk borrowers may be denied access to credit when moving abroad as they are forced to restore their credit worthiness from scratch.

Outdated analysis and incomplete information

When information becomes more centralized, it is monopolistic and incomplete. This leads to a decision without the information available, which greatly increases the associated risk. In addition, credit scores are not updated in real time, and delays are set by millions of consumers and businesses because their current credit history is not taken into account in the decision-making process.

Credit solutions

As a solution to the above problems, we have only created Credito Network or Credito. Decentralized networks based on the Ethereal Block chain, combined with Intellectual Property and Interplanetary File Systems (IPFS), provide decentralized credit and credit markets. Credito promotes the work of a thriving and high-quality banking industry that enables financial institutions and digital resource loans to lend people and institutions a backward or independent credit system. The ecosystem provides solutions that allow trusted lenders to issue safe and secure loans to audited borrowers.

Credito design principles and values.

Decentralization.

Decentralization is not only the basis for protection against unauthorized access, but also for its infinity. By setting up a decentralized system, we want to further expand the conflict-free development within Credito. We believe that decentralization is an important component of a thriving global ecosystem with long-term sustainability.

Modularity for simple and flexible systems.

We value the philosophy of developing small tools that work well. Simple components are easy to lay out and can be reliably integrated into larger systems. We believe that modularity not only allows the modernization system, but also contributes to decentralization.

Safe, transparent and expandable system.

Credito built for the community. We value the community and will continue to work with data researchers, experts, scientists and security experts to evaluate them. We request official tests, audits and safety proofs to create a platform whose reliability and safety can support future innovations.

The election contract has two main tasks:

- Response to individual credit account requirements

- Review requirements for third-party transaction calculations. In addition, loan balances and utilization rates are monitored.

For certain analysis nodes, leases control the following indicators:

Total number of queries assigned: Number of last node-approved requests, completed and not executed.

Total number of completed queries: Total number of recent queries performed by the node. This can be averaged based on the number of requests assigned to calculate the completion rate.

Average response time: Punctuality of the nodal response, which is an indicator of the node's effectiveness. The average response time is calculated based on completed queries.

Website reputation: Website reputation based on previous transactions. All nodes check and score each point, and if most nodes return the same value, the node becomes reliable. This reputation system helps identify and remove malformed websites from the network.

Credit - Online Credit Report

Loans are the ERC20 tokens that Credito uses as its currency, management mechanism and rewards system. Credito will be able to set prices and receive payments for its services in the form of loans.

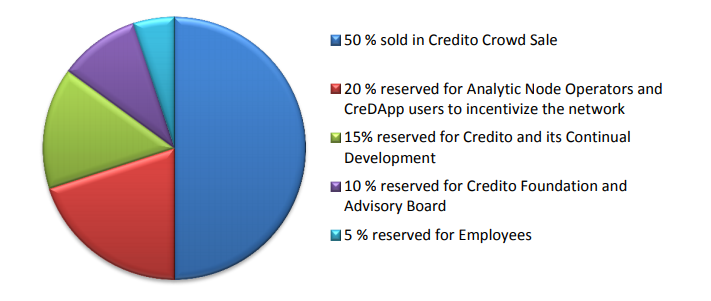

Token distribution

To continue the development, Credito will conduct a one-off "TGE" Generation and Sell Sales Loan, with 50% of the tokens available for public sale. The TGE start date will be announced shortly and will provide loans totaling US $ 1 billion. As follows:

- The employee distribution has a 12-month transitional period, 25% - every quarter, with 6 months old rock. The allocation is proportional to the ownership of each employee on the day the token is sold.

- With the distribution of Dana Credito, the transitional period is 12 months.

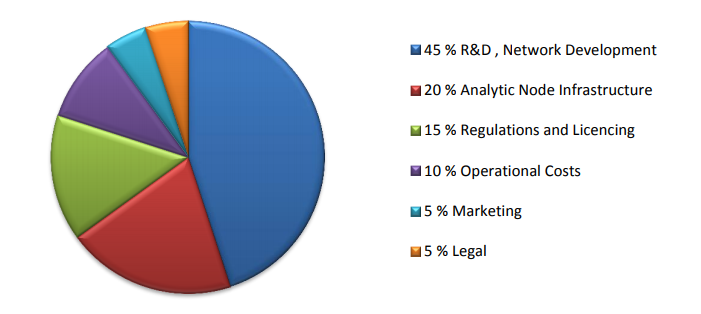

Use of the funds provided

Road map

Credito will expand in 6 stages and set important milestones in each phase.

Stage1 completed

- Concepts and research.

- credit registry

- White Paper

- Proof of the concept is a high-speed transaction system.

- Starting a website

Registration, verification and partnership in the second phase

- CreDApp interface development

- user Registration

- Automatic ID verification

- In close cooperation with financial institutions

Phase 3 Infrastructure and Intelligence Development

- Development of external APIs.

- Infrastructure of analytical nodes.

- Development of credit development.

- Create a credit score.

- Modeling the transaction estimate

Stage 4 Development and Dissemination of Intellectual Contracts

- Calculations and leases of intellectual contracts.

- Intelligent audit exam

- Integrated intelligent contract with Credito Analytic Engine and node infrastructure.

- Runs on the test network.

- Try the trial version, give your partner a direct result.

Stage 5 start

- The main network starts.

- Decentralized intelligence controls are available for couples.

- External Analysis Node The operator that connects the network.

- Marketing and new partnerships.

The protocol of the 6th stage of end-to-end loans in large networks

- Develop CreDApp and mobile apps

- Development and audit of the credit agreement Smart Credit

- CreDApp brand with Credit Smart Credit Credit Integration

- CreDApp in the test network and the transition to the main network

For more information:

WEBSITE: https: //credito.io/

WHITE PAPER: https: //credito.io/pdf/whitepaper.pdf

FACEBOOK: https://www.facebook.com/CreditoNetwork

TWITTER: https://twitter.com/CreditoNetwork

TELEGRAM: https: //t.me/CreditoCommunity

My Bitcointalk (doblok) : https://bitcointalk.org/index.php?action=profile;u=1035549

My ETH Address : 0x45CC001673969f7a5e77ab858BaD85d650427227

Tidak ada komentar: